If the net amount is a negative amount, it is referred to as a net loss. In our examples below, we show how a given transaction affects the accounting equation. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. The accounting equation is a better representation of the dreaded “double entry bookkeeping system”. Equity refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted.

Get in Touch With a Financial Advisor

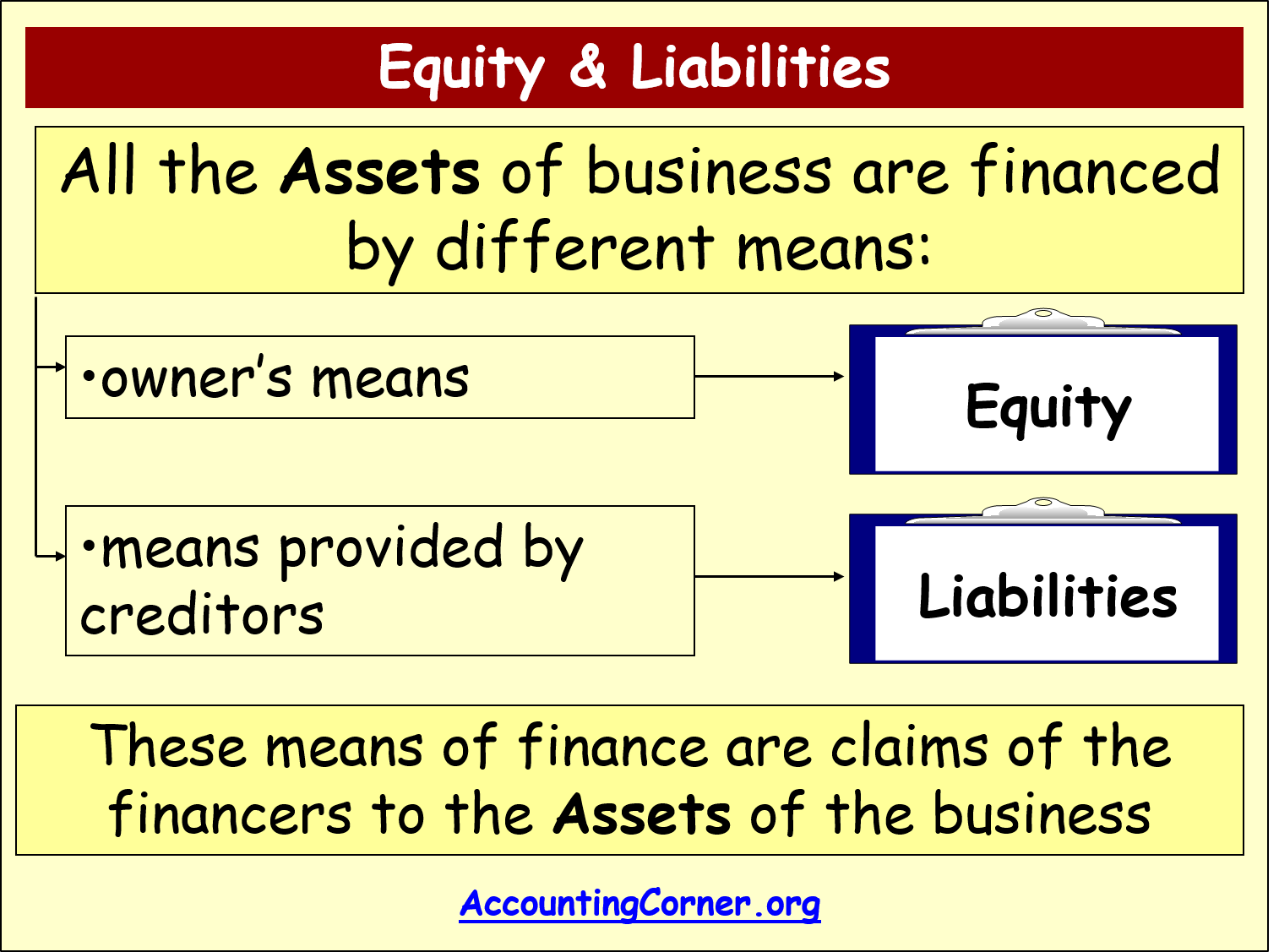

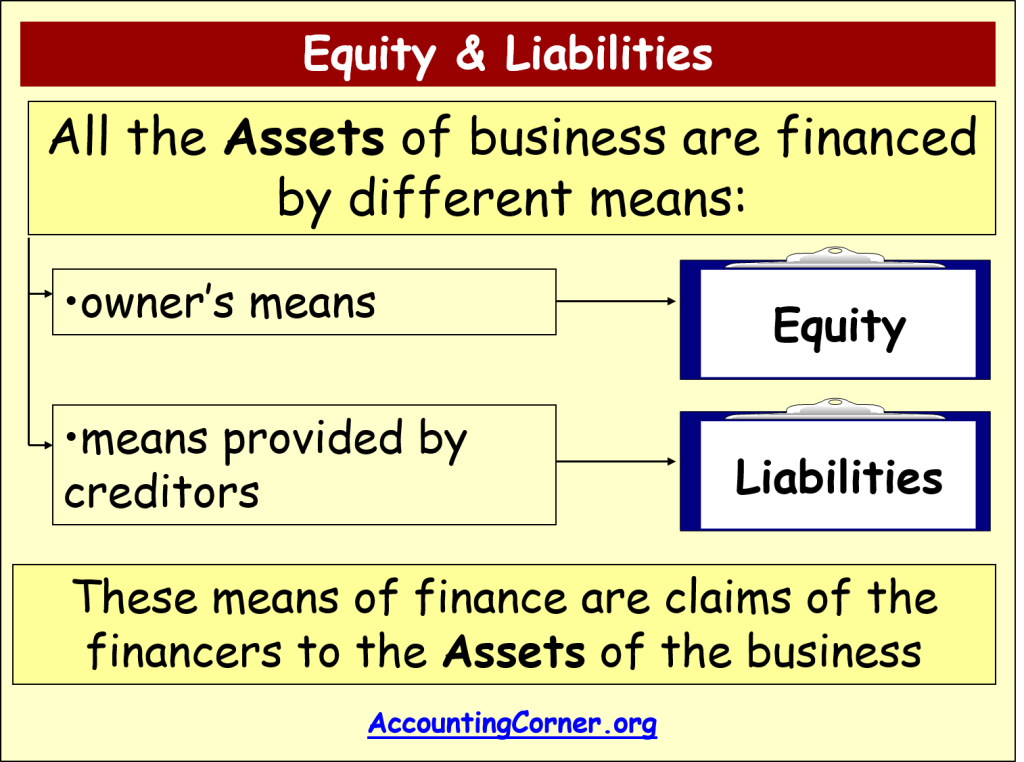

Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. For now, let’s just keep things simple and think about how we can expand to basic accounting equation into an expanded accounting equation. The accounting equation is not always accurate if it is unbalanced. This can lead to inaccurate reporting of financial statements and incorrect decisions made by management regarding money and investment opportunities. To further illustrate the analysis of transactions and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation.

Balance Sheet and Income Statement

While single-entry accounting can help you kickstart your bookkeeping knowledge, it’s a dated process that many other business owners, investors, and banks won’t rely on. That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. While the accounting equation goes hand-in-hand with the balance sheet, it is also a fundamental aspect of the double-entry accounting system.

Liabilities

A loan from a bank is a liability because you’ll eventually have to repay it. A building that you own is an asset because you’ll earn money from it, either by renting it out, or using it to deliver services or manufacture products. However, this scenario is extremely rare because every transaction always has a corresponding entry on each side of the equation. Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days.

- An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future.

- Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit).

- Largely because those assets tend to be “fixed” (e.g., buildings).

- Due within the year, current liabilities on a balance sheet include accounts payable, wages or payroll payable and taxes payable.

- On 2 January, Mr. Sam purchases a building for $50,000 for use in the business.

- For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors.

In another way, it shows us a firm’s resources and its sources of finance. Where “future economic outflows” is a sophisticated way of saying you expect to pay money. Liabilities on the other hand, are things that we owe, and expect to pay money for. Analyze a company’s financial records as an analyst on a technology team in this free job simulation.

Understanding the Components of the Accounting Equation

These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements. This includes expense reports, cash flow and salary and company investments. If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. To learn more about the balance sheet, see our Balance Sheet Outline.

It will always be true as long as all transactions are appropriately accounted for and can never fail or be out of balance for any given entity. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. retail marketing guide to email marketing And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. Net value refers to the umbrella term that a company can keep after paying off all liabilities, also known as its book value.

Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets. The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance. To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides.